Understanding Bitcoin Market Manipulation: Key Indicators

What is Bitcoin Market Manipulation and Why Does it Happen?

Bitcoin market manipulation refers to the deliberate actions taken by individuals or groups to influence the price of Bitcoin for their own advantage. This might involve tactics like pump-and-dump schemes where prices are artificially inflated before being sold off for profit. Understanding why manipulation occurs is crucial; it's often rooted in the desire for quick profits and can be exacerbated by the relatively unregulated nature of cryptocurrency markets.

In the world of cryptocurrency, the only constant is volatility, and with it, the potential for manipulation.

In many cases, manipulators exploit the emotional reactions of investors. For example, a sudden surge in price can trigger fear of missing out (FOMO), leading more people to buy in, which further drives up prices. This cycle can create a false sense of security among new investors, making them more vulnerable to manipulation tactics.

Moreover, the anonymity offered by cryptocurrencies allows manipulators to operate without immediate consequences. This lack of transparency can lead to a distrustful environment, where genuine investors are left questioning the integrity of the market. Understanding the roots of manipulation helps investors stay alert and informed.

Common Techniques Used in Bitcoin Market Manipulation

There are several common techniques employed in Bitcoin market manipulation that investors should be aware of. One prevalent method is known as 'pump and dump,' where the price of a coin is artificially inflated by spreading false or misleading information. Once the price peaks, the manipulators sell off their holdings, leaving unsuspecting buyers with depreciating assets.

Another technique is 'wash trading,' which involves buying and selling Bitcoin among the same group of traders to create the illusion of increased trading volume. This tactic can mislead investors into thinking that a particular cryptocurrency is gaining popularity, prompting them to invest when in reality, it's just a facade.

Understanding Market Manipulation

Bitcoin market manipulation involves tactics like pump-and-dump schemes, driven by the desire for quick profits and the unregulated nature of cryptocurrency markets.

Additionally, 'spoofing' is a tactic where traders place large orders they never intend to execute to create a false sense of demand or supply. This can manipulate market movements and drive prices in directions that benefit the manipulator, often at the expense of unsuspecting investors.

Key Indicators of Market Manipulation to Watch For

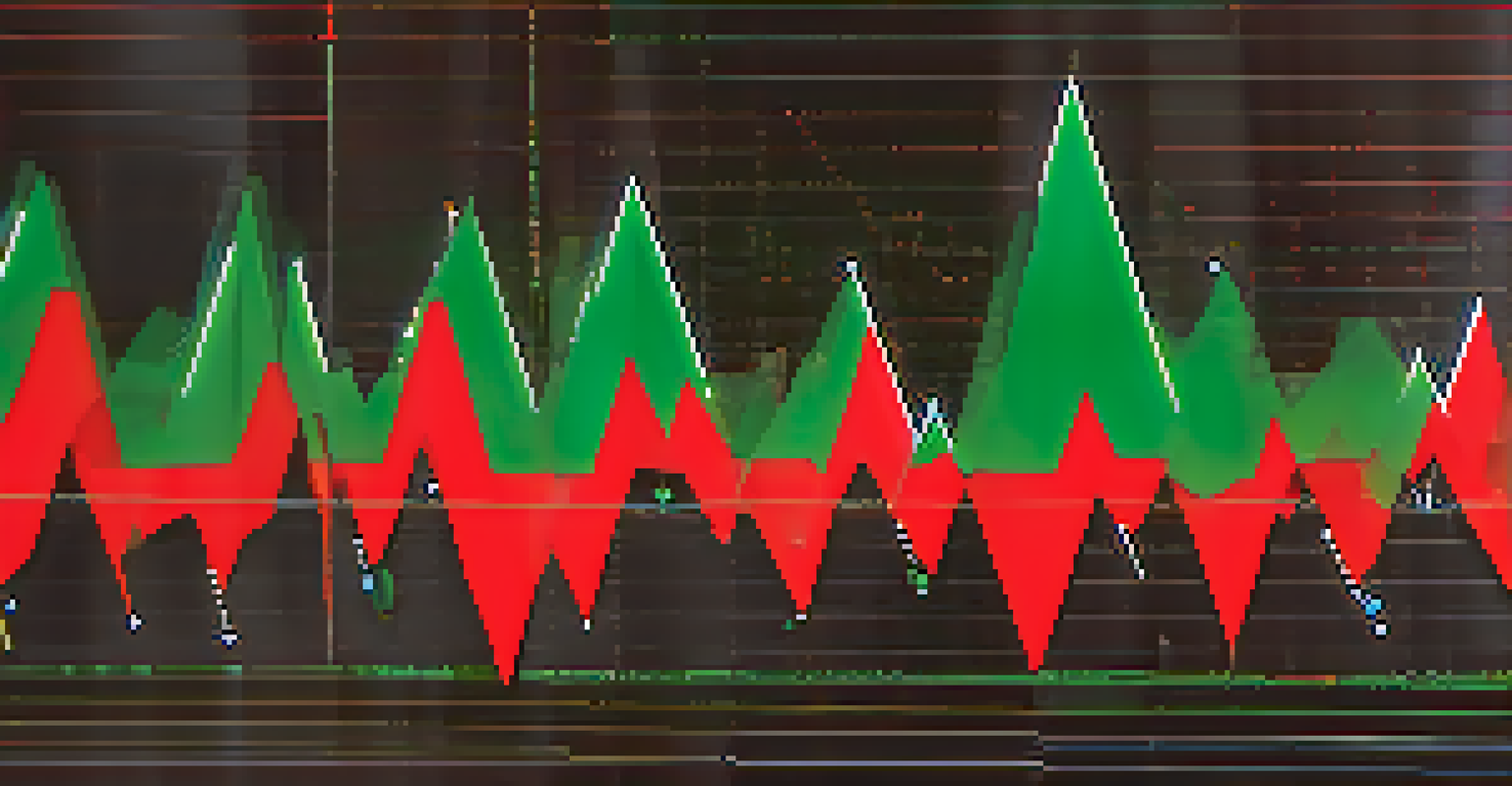

Recognizing the signs of market manipulation is essential for protecting your investments. One key indicator is unusual price volatility, where dramatic price changes occur within short time frames. This can signal that something isn't quite right, and caution should be exercised before making any trades.

Investing without understanding the market is like sailing without a compass; you may end up lost in turbulent waters.

Another warning sign is abnormal trading volume. If you notice a sudden spike in volume that doesn't align with market news or trends, it could indicate that manipulation is taking place. Keeping an eye on trading patterns can provide insights into whether the market is behaving normally or if something suspicious is afoot.

Lastly, watch for sudden news events or social media trends that seem to influence Bitcoin prices disproportionately. Often, these events can be engineered to create hype or panic, leading to manipulative price swings. A healthy skepticism about such events can help you make more informed decisions.

The Role of Social Media in Bitcoin Market Manipulation

Social media has become a double-edged sword in the world of Bitcoin trading. On one hand, it serves as a platform for sharing valuable insights and updates; on the other, it can be a breeding ground for manipulation. Traders often exploit social media to spread rumors or hype about Bitcoin, creating artificial price movements that can lead to significant losses for unsuspecting investors.

Platforms like Twitter and Reddit have communities dedicated to cryptocurrency discussions, making it easier for manipulators to influence public sentiment. A carefully timed tweet or post can sway thousands of followers, leading to rapid buying or selling. It's crucial for investors to discern credible information from hype-driven noise.

Recognizing Manipulation Indicators

Key indicators of market manipulation include unusual price volatility, abnormal trading volume, and sudden news events that disproportionately impact Bitcoin prices.

To navigate this landscape, always verify information through multiple reliable sources before making investment decisions based on social media trends. Building a solid understanding of Bitcoin fundamentals can help you critically evaluate the information circulating online.

How Regulation Affects Bitcoin Market Manipulation

Regulation plays a significant role in shaping the dynamics of Bitcoin trading and can help mitigate market manipulation. In a regulated environment, stringent rules and oversight can deter bad actors who might otherwise engage in manipulative practices. However, the global nature of cryptocurrency makes it challenging to enforce consistent regulations across different jurisdictions.

For instance, countries like the United States have begun implementing regulations to protect investors, but gaps still exist. In unregulated markets, the potential for manipulation increases as traders can operate with less fear of repercussions. A lack of oversight can create an environment where unethical practices thrive, putting genuine investors at risk.

As the cryptocurrency landscape evolves, greater regulatory clarity can help create a safer trading environment. Investors should stay informed about regulatory developments, as they can have a direct impact on market behavior and the prevalence of manipulation.

Protecting Yourself from Bitcoin Market Manipulation

Protecting yourself from Bitcoin market manipulation starts with education. Understanding the market, its indicators, and the risks involved can empower you to make informed decisions. Take the time to research Bitcoin and familiarize yourself with common manipulation tactics so you can recognize them when they occur.

It's also wise to develop a trading strategy based on your financial goals. Avoid making impulsive decisions based on fear or hype, as these emotions can cloud your judgment. Stick to your plan and consider setting limits on your trades to minimize potential losses during volatile periods.

Protecting Yourself from Risks

Educating yourself about market dynamics and developing a solid trading strategy can help safeguard against the risks of Bitcoin market manipulation.

Finally, consider diversifying your investments rather than putting all your funds into Bitcoin alone. A diversified portfolio can help mitigate risks associated with market manipulation, providing a buffer against sudden price swings. Remember, a well-rounded approach to investing is often more resilient against market uncertainties.

Conclusion: Staying Informed and Vigilant

In conclusion, understanding Bitcoin market manipulation is crucial for any investor looking to navigate this volatile landscape. By being aware of common manipulation techniques and key indicators, you can better protect your investments and make informed decisions. The cryptocurrency market is still relatively young, and as such, it requires vigilance and a proactive approach to investing.

Stay engaged with market trends and be critical of the information you consume, especially from social media. Knowledge is your best defense against manipulation, and fostering a healthy skepticism can help you avoid falling into traps set by unscrupulous traders.

Ultimately, the more informed you are about the dynamics of Bitcoin trading, the more confident you'll feel in your investment choices. Keep learning, stay alert, and you'll be better equipped to navigate the complexities of the cryptocurrency market.