How Bitcoin Can Transform Global Remittance Systems Today

Understanding Bitcoin's Role in Remittances

Bitcoin, a decentralized digital currency, offers a revolutionary approach to remittances. Unlike traditional methods that rely on banks and money transfer services, Bitcoin enables peer-to-peer transactions. This means that anyone with an internet connection can send and receive money globally without the need for intermediaries.

Bitcoin is a technological tour de force.

For many, especially in developing countries, sending money home can be a costly affair due to high fees charged by financial institutions. Bitcoin has the potential to drastically reduce these costs, making it a more affordable option for families relying on remittances for their livelihood. This shift could change the financial landscape for millions.

Moreover, Bitcoin operates on a blockchain, which ensures transparency and security in transactions. This technology minimizes the risk of fraud and provides a clear record of all transactions, enhancing trust among users. As more individuals understand Bitcoin's capabilities, its adoption for remittances is likely to increase.

Lowering Transaction Costs with Bitcoin

One of the most appealing aspects of using Bitcoin for remittances is the significant reduction in transaction fees. Traditional remittance services often charge anywhere from 5% to 20% of the transaction amount. In contrast, Bitcoin transactions can be processed for a fraction of that cost, often just a few dollars or even less, depending on network congestion.

This cost-effectiveness is particularly beneficial for low-income workers who send money back home. For example, a migrant worker sending $200 home could save a substantial amount on fees by opting for Bitcoin instead of traditional channels, allowing more funds to reach their families. Over time, these savings can accumulate, providing greater financial support.

Lower Fees for Global Remittances

Bitcoin significantly reduces transaction costs compared to traditional remittance services, making it more affordable for families in need.

Additionally, Bitcoin's borderless nature means that users can send money to almost any country without worrying about exchange rates or additional charges. This feature simplifies the process and makes it more accessible, especially for those in rural or underserved areas.

Speeding Up Remittance Transactions

Speed is another critical advantage of using Bitcoin for remittances. Traditional money transfers can take several days to process, especially if they involve multiple banks and currency exchanges. Bitcoin transactions, on the other hand, can be completed in a matter of minutes, regardless of the sender's or recipient's location.

The future of money is digital currency.

This quick turnaround is not only convenient for senders, but it also provides immediate financial relief to recipients. For families waiting for support during emergencies, the ability to access funds almost instantly can be life-changing. Imagine being able to send money to a loved one in crisis within minutes instead of days.

The speed of Bitcoin transactions is further enhanced by the use of various digital wallets and platforms that facilitate these transfers. With user-friendly interfaces and instant notifications, users can track their transactions in real time, fostering a sense of control and reassurance.

Increasing Accessibility to Financial Services

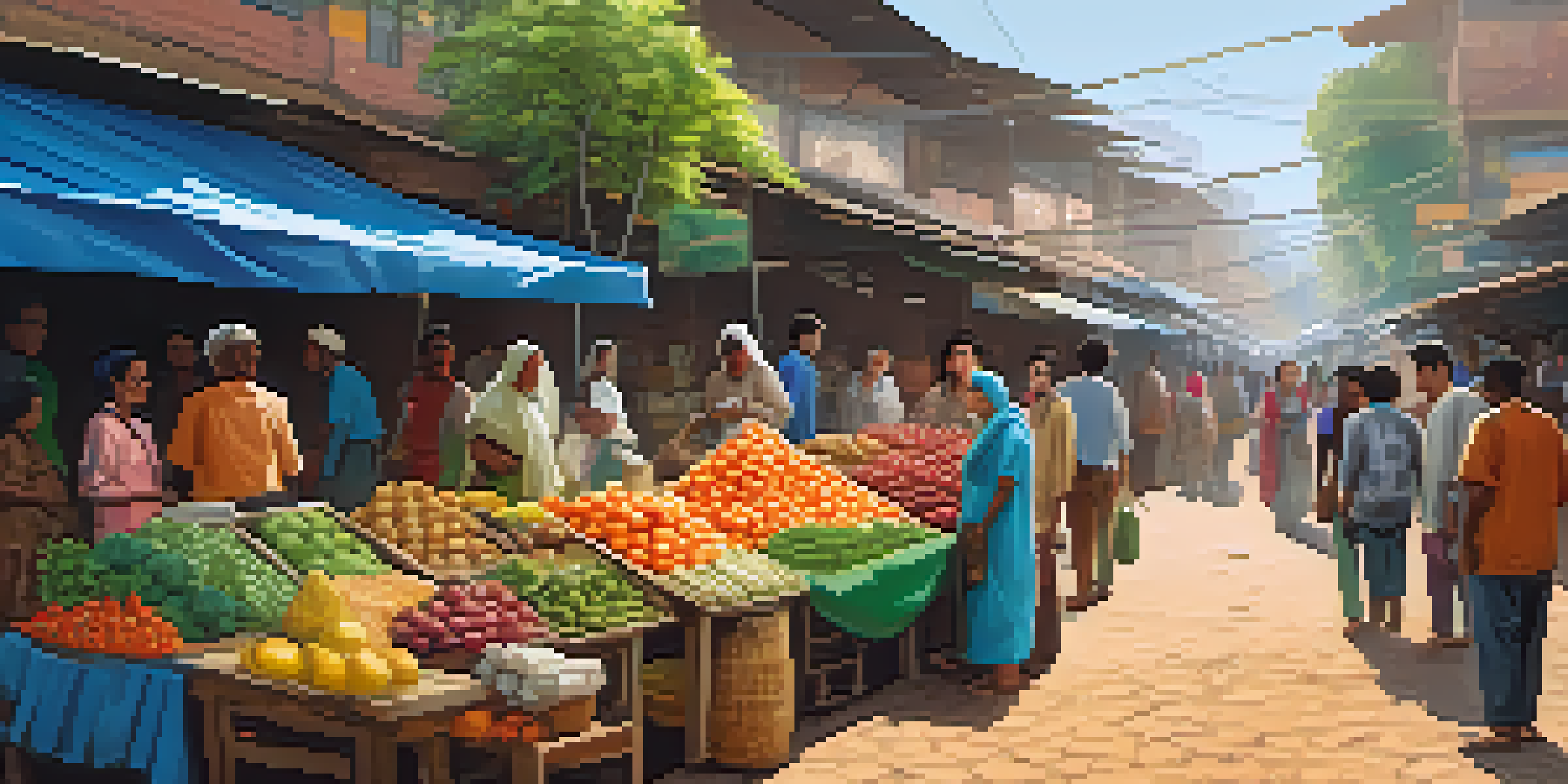

Bitcoin's decentralized nature makes it an attractive option for individuals who lack access to traditional banking services. In many parts of the world, especially in rural areas, people remain unbanked due to geographical and economic barriers. Bitcoin can bridge this gap by providing an alternative financial system that anyone can join.

All you need is a mobile device and an internet connection to start using Bitcoin. This accessibility empowers people to participate in the global economy, enabling them to send and receive money without the constraints imposed by banks. It's a game changer for those previously excluded from financial systems.

Faster Transactions with Bitcoin

Bitcoin transactions can be completed in minutes, providing immediate financial relief to recipients during emergencies.

Furthermore, as Bitcoin continues to gain traction, more businesses and services are emerging to support its use. This growing ecosystem makes it easier for users to exchange Bitcoin for local currency, pay bills, and even make purchases, further integrating them into the financial landscape.

Enhancing Security and Reducing Fraud Risks

Security is a top concern for anyone dealing with money transfers, and Bitcoin offers robust solutions. Transactions are recorded on a blockchain, which is a secure and immutable ledger. This means once a transaction is completed, it cannot be altered or deleted, providing users with peace of mind.

Additionally, Bitcoin transactions do not require personal information, which reduces the risk of identity theft and fraud. Unlike traditional remittance services that often ask for sensitive details, Bitcoin allows users to maintain their privacy while still completing secure transactions. This aspect is especially appealing in regions where financial fraud is prevalent.

As the technology behind Bitcoin evolves, so do the security measures in place to protect users. With advancements in encryption and multi-signature wallets, users can enhance their security further, making Bitcoin a reliable choice for remittances.

Supporting Economic Growth in Developing Countries

The adoption of Bitcoin for remittances can significantly impact economic growth in developing nations. With lower transaction fees and faster processing times, more money can flow into these economies, stimulating local businesses and communities. This influx of cash can help lift families out of poverty and create new opportunities.

Moreover, as more individuals embrace Bitcoin, the demand for local services that accept this digital currency will grow. This shift could encourage entrepreneurs to innovate and create businesses that cater to Bitcoin users, further driving economic development. Picture a local shop that begins accepting Bitcoin, making it easier for customers to spend their remitted funds.

Increased Accessibility to Finance

Bitcoin offers a decentralized solution for those without access to traditional banking, empowering more individuals to participate in the global economy.

In essence, Bitcoin has the potential to empower communities and create a more inclusive financial system. As remittances become more efficient, families can invest in education, healthcare, and other essential services that contribute to long-term economic stability.

Overcoming Challenges in Bitcoin Adoption

While the benefits of using Bitcoin for remittances are compelling, there are challenges to overcome for widespread adoption. One major hurdle is the lack of understanding and awareness about how Bitcoin works. Many potential users may feel intimidated by the technology, fearing they might lose their funds or make mistakes during transactions.

Education and outreach initiatives are crucial to demystifying Bitcoin and empowering users to embrace its advantages. By providing clear, accessible information and resources, organizations can help individuals feel more comfortable using Bitcoin for remittances. Think of it like teaching someone to ride a bike; once they understand the mechanics, they gain confidence and can enjoy the ride.

Additionally, regulatory hurdles can pose challenges to Bitcoin adoption in certain regions. Governments may have concerns about the implications of cryptocurrencies, creating a complex landscape for users. However, as more people recognize the benefits of Bitcoin, there's potential for collaboration between regulators and Bitcoin advocates to create a safe and supportive environment for users.