Bitcoin in Remittances: Cost Efficiency Over Traditional Methods

Understanding Remittances and Their Costs

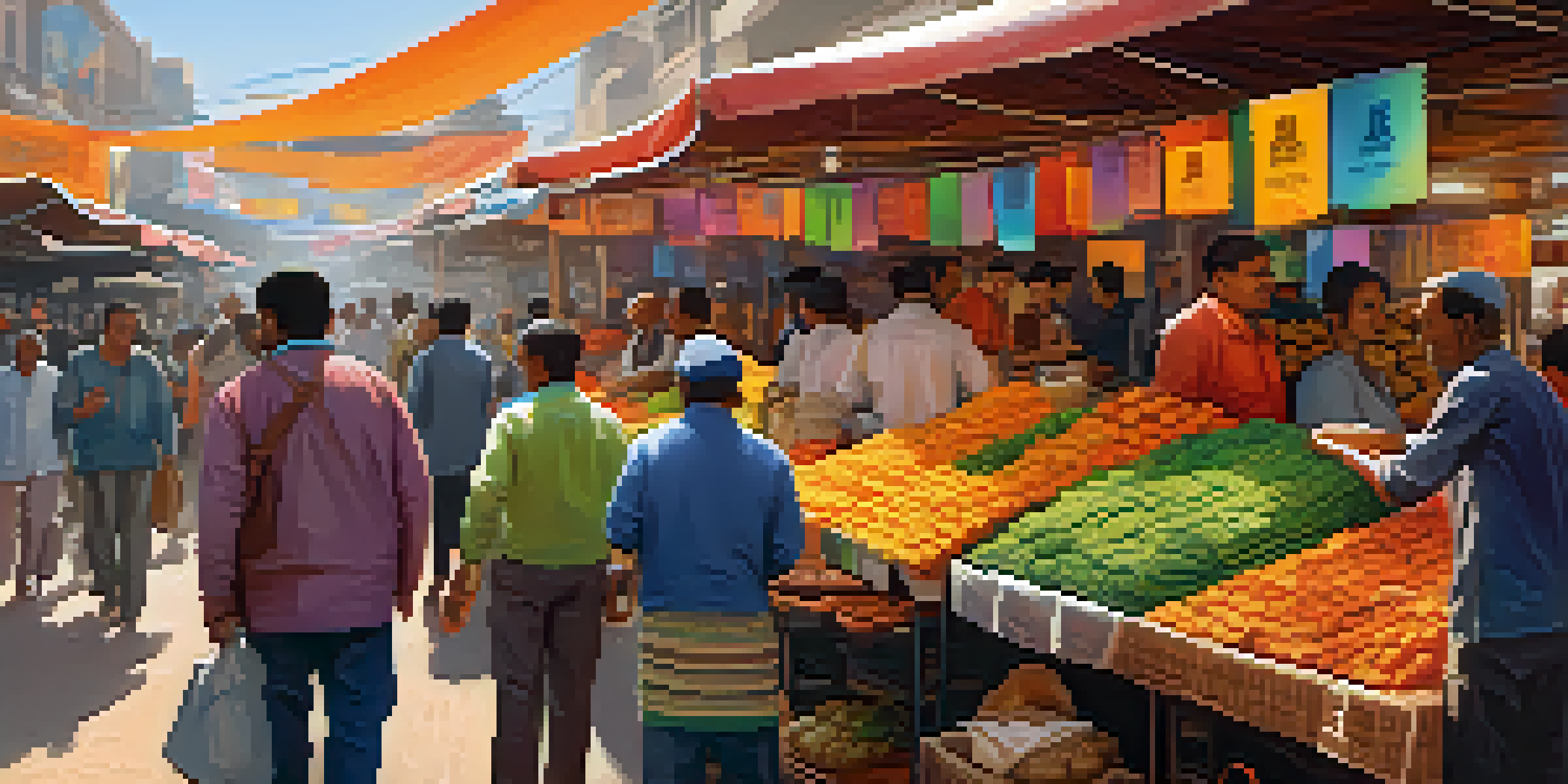

Remittances are funds sent from one country to another, often by migrants to support their families back home. They play a crucial role in the economies of many developing countries, providing financial lifelines to millions. However, traditional remittance methods often come with high fees that can eat into the amount received.

Bitcoin is a technological tour de force.

On average, sending money internationally can incur fees ranging from 5% to 10%, depending on the service used. These costs can significantly burden senders, especially those who are already financially strained. This is where Bitcoin starts to shine, offering an alternative that could change the game.

Bitcoin transactions typically have lower fees compared to traditional remittance services. The decentralized nature of Bitcoin allows for peer-to-peer transactions, eliminating the need for intermediaries and their associated costs.

The Mechanics of Bitcoin Transactions

Sending Bitcoin is relatively straightforward, akin to sending an email. The sender uses a digital wallet to transfer Bitcoin to the recipient's wallet address. This process can be completed in minutes, regardless of geographical barriers, making it incredibly efficient.

Unlike traditional banks that may take days to process international transfers, Bitcoin transactions are usually confirmed within an hour. This speed can be crucial for families needing immediate support or in emergency situations.

Cost-Effective Global Transfers

Bitcoin offers a cheaper alternative to traditional remittance services, significantly reducing fees for senders.

It’s important to note that while transaction times are generally quick, Bitcoin's value can fluctuate significantly. This volatility can affect the amount received by the recipient, but many find the overall cost savings worth the risk.

Comparing Bitcoin with Traditional Services

When comparing Bitcoin to services like Western Union or MoneyGram, the differences in cost and speed become evident. Traditional services often charge flat fees plus a percentage of the amount being sent, which can quickly add up.

The future of money is digital currency.

In contrast, Bitcoin’s fees depend on network congestion and are typically much lower. For example, sending $500 through a traditional service may incur a fee of $50 or more, while sending the same amount in Bitcoin could cost just a few dollars.

This cost efficiency can make a substantial difference for low-income families who rely on every dollar sent. Over time, the savings from using Bitcoin could lead to better financial stability for these families.

Security and Transparency of Bitcoin

One of the main concerns people have about using Bitcoin is security. However, Bitcoin transactions are secured by blockchain technology, which provides transparency and a high level of security. Each transaction is recorded on a public ledger, making it nearly impossible to alter once confirmed.

This transparency can build trust among users, as they can verify transactions independently. Additionally, Bitcoin transactions do not require personal information, which can help protect users from identity theft.

Speedy Transactions with Bitcoin

Unlike traditional methods that can take days, Bitcoin transactions are typically confirmed within an hour.

Yet, while Bitcoin is secure, users must still take precautions, such as using secure wallets and understanding best practices to avoid scams. Education about these risks is crucial for new users.

Challenges in Adopting Bitcoin for Remittances

Despite its advantages, Bitcoin is not without hurdles. Many potential users lack understanding or access to the technology needed to send and receive Bitcoin. This digital divide can hinder the widespread adoption of Bitcoin for remittances.

Additionally, regulatory uncertainties in many countries pose challenges. Some governments have restrictions on cryptocurrency use, which can complicate the process for users wanting to send remittances via Bitcoin.

Moreover, the volatility of Bitcoin's price can deter potential users. Individuals may be hesitant to use Bitcoin for remittances if they are concerned about the potential for value loss during the transaction process.

The Global Reach of Bitcoin in Remittances

One of Bitcoin's most significant advantages is its global reach. Unlike traditional banking systems that may be limited by geography, Bitcoin can be sent and received anywhere in the world where there is internet access.

This global nature allows for easier connections between families and friends across borders, particularly for those in underserved regions where traditional banking services are scarce. This democratization of finance can empower individuals in developing nations.

Challenges in Bitcoin Adoption

Despite its benefits, Bitcoin faces hurdles such as lack of understanding, regulatory issues, and price volatility that impact its adoption for remittances.

Moreover, as more people become aware of Bitcoin's potential, its adoption for remittances is likely to grow. This could lead to a more inclusive financial ecosystem, where everyone has access to efficient and cost-effective money transfer options.

Looking Ahead: The Future of Bitcoin in Remittances

As technology continues to evolve, the future of Bitcoin in remittances looks promising. Innovations such as the Lightning Network are being developed to facilitate quicker and cheaper transactions. This could further enhance Bitcoin's appeal as a remittance solution.

Moreover, as more businesses and individuals adopt cryptocurrency, we may see a shift in public perception. Increased awareness and education about Bitcoin could lead to broader acceptance, making it a mainstream option for sending money.

Ultimately, the potential of Bitcoin to revolutionize remittances lies in its ability to provide a more cost-effective, secure, and efficient alternative to traditional methods. As the world becomes more interconnected, Bitcoin may well become a preferred choice for millions.